Renters Insurance in and around Little Neck

Get renters insurance in Little Neck

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

There's a lot to think about when it comes to renting a home - number of bedrooms, internet access, price, condo or house? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in Little Neck

Rent wisely with insurance from State Farm

Renters Insurance You Can Count On

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects your valuable possessions with coverage. If you experience vandalism or a tornado, some of your most treasured items could have damage. Without adequate coverage, the cost of replacing your items could fall on you. It's scary to think that in one moment, you could risk losing all your possessions. Despite all that could go wrong, State Farm Agent Kelly Escobar is ready to help.Kelly Escobar can help offer options for the level of coverage you have in mind. You can even include protection for valuables when they are outside of your home. For example, if your personal property is damaged by a fire, your car is stolen with your computer inside it or your bicycle is stolen from work, Agent Kelly Escobar can be there to help you submit your claim and help your life go right again.

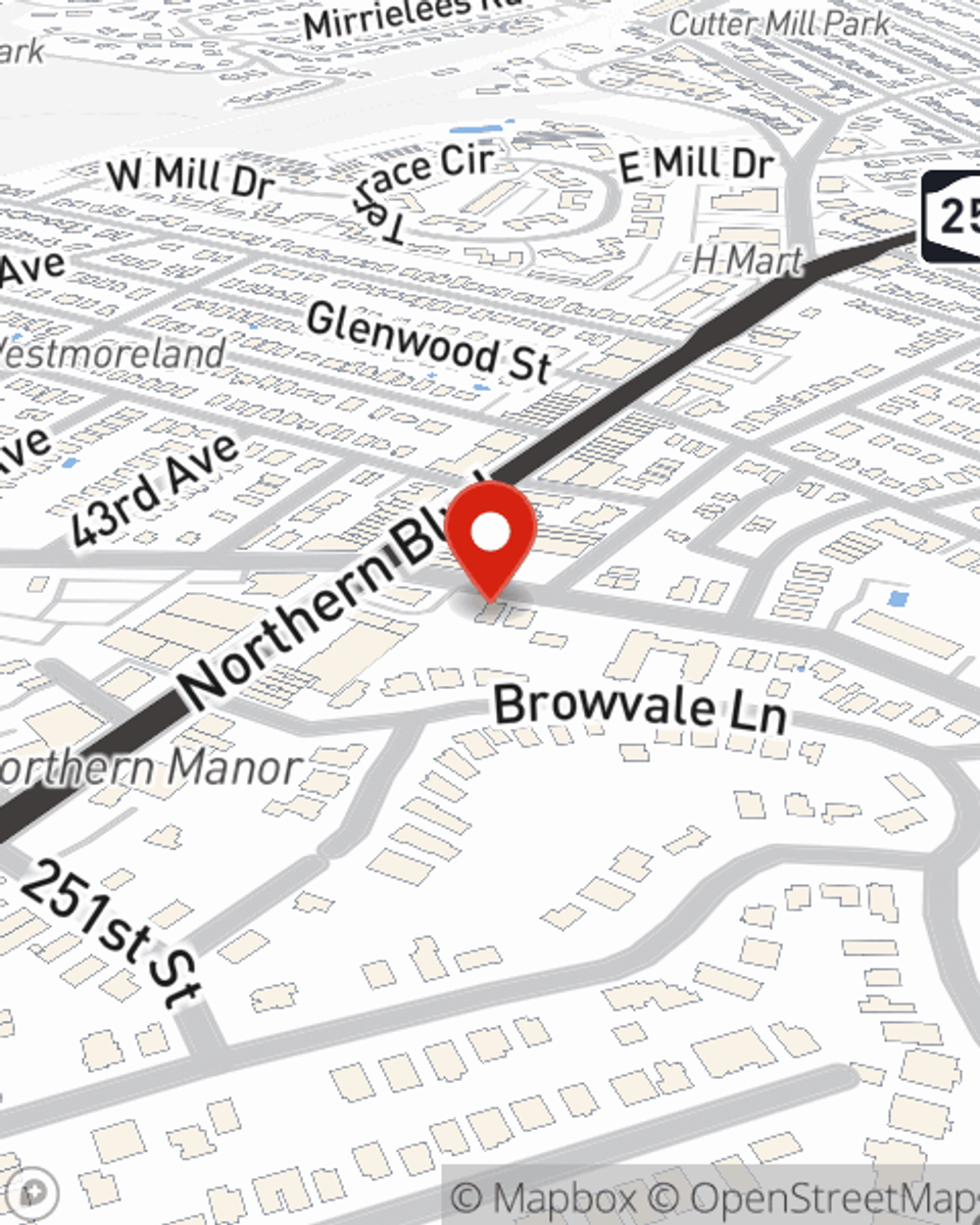

Reach out to State Farm Agent Kelly Escobar today to experience how the leading provider of renters insurance can protect your possessions here in Little Neck, NY.

Have More Questions About Renters Insurance?

Call Kelly at (718) 819-8000 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Kelly Escobar

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.