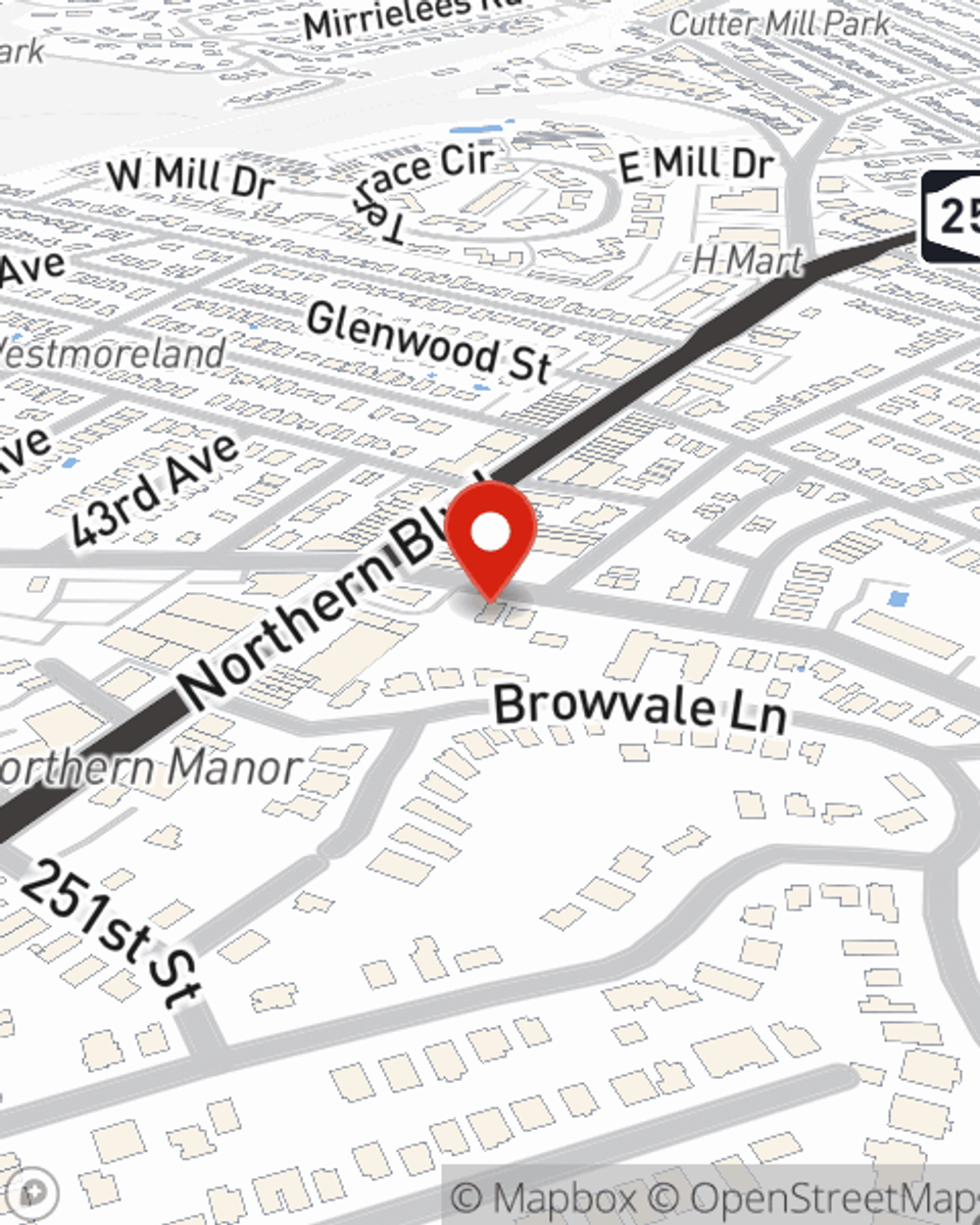

Business Insurance in and around Little Neck

Get your Little Neck business covered, right here!

Almost 100 years of helping small businesses

Coverage With State Farm Can Help Your Small Business.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Accidents happen, like an employee gets hurt on your property.

Get your Little Neck business covered, right here!

Almost 100 years of helping small businesses

Keep Your Business Secure

No one knows what tomorrow will bring—especially in the business world. Since even your most detailed plans can't predict global catastrophes or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like business continuity plans and errors and omissions liability. Terrific coverage like this is why Little Neck business owners choose State Farm insurance. State Farm agent Kelly Escobar can help design a policy for the level of coverage you have in mind. If troubles find you, Kelly Escobar can be there to help you file your claim and help your business life go right again.

Curious to explore the specific options that may be right for you and your small business? Simply call or email State Farm agent Kelly Escobar today!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Kelly Escobar

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.